city of chattanooga property tax increase

Property tax collections represents about 59 of the Citys general fund annual operating budget. CITY OF CHATTANOOGA TREASURY DEPARTMENT 101 E 11TH ST ROOM 100 CHATTANOOGA TN 37402-----PROPERTY TAX RELIEF PROGRAM.

Chattanooga Monopoly No Way That S Pretty Specific Tennessee Chattanooga Chattanooga Tennessee Tennessee

The 125 is an increase from that.

. The current tax rate is 225 per 100 of assessed valuation. If you live in a city you will have an additional city property tax rate ranging from 020 to 255 per 100. The tax rate under the Kelly budget would be 225 - 40.

Additionally all feespenalties may NOT appear online. Downtown Chattanooga produced more than 32 million dollars in property tax revenue for the City of Chattanooga and Hamilton County in 2017 according to a new report. City Council Unanimously Approves Budget On 2nd Reading That Includes 40-Cent Property Tax Increase Tuesday September 28 2021 At his desk in City Hall Mayor Tim Kelly signs Council-approved.

Chattanooga City Council postpones final budget vote over notice issue The budget was approved initially by the city council on. Pay Fines and Search Dockets. Chattanooga home- and property-owners could see an increase in their property tax bills leading into 2022 as part of a new city budget that aims to bump pay for first responders and essential workers afford infrastructure investments and pave the way for equitable growth.

Doing Business with the City. If you wish to pay prior year water quality fees by credit or debit card. So the average property tax went up by 107 percent for county government.

Thank you for visiting the City of Chattanooga. The City Council on Tuesday night unanimously approved a 40-cent property tax increase above the new certified rate. The Industrial Development Board of the City of Chattanooga Tennessee Board or IDB serves as the governing body of the TIF Program.

The city of Chattanooga announced a 03 cent rollback from 230 to 227 per hundred of. Ten years of tax information is available online. 2 a way to capture and monetize the incremental increase in property taxes after development occurs.

What is the property tax rate in Chattanooga TN. You may contact our office to verify the current amount by e-mail at ptaxchattanoogagov or call 423-643-7262. Since assessed value is about 14 the price of your home you must have paid at least 800k for your home.

The city of Chattanooga will rely on a proposed 30 million increase in property tax revenue for the budget year that started last month to. Based on your assumption that an 18 increase will cost you 1000 more per year that means your current tax is 5500. The Tax Rate is set by City Council each year as part of the annual budget process.

The increase raises some 30 million in new income. The City of Chattanooga property tax rate is 2250 per 100 assessed value for 2021. Tuesday September 7 2021.

To set the rate so that the city would gain no additional revenue from rising property values the city would charge a rate of 09929 per 100 of assessed value. The new certified tax rate for Chattanooga is 18529 per 100 of assessed value. This is in addition to the.

To look up your bill number use the City of Chattanooga property tax search engine. The property tax rate in Hamilton County Tennessee is 22373 per 100 assessed value. That means your assessed value is about 200K.

The Office of the City Treasurer administers a state-funded Tax Relief Program to help taxpayers 65 or older disabled citizens 100 service-disabled veterans and widower of 100 service-disabled veterans pay their property taxes. Current tax rate is 276 per 100 of assessed value. That figure increases to 445 million dollars when the North Shore is included.

Prior year delinquent taxes that have not been turned over to Chancery Court and prior year WQ Fees are payable to the City of Chattanooga directly by cash or check only. Thats because Chattanooga property values have increased by an average of 109 percent after the recent Hamilton County reappraisal. The City of Chattanooga retains no portion of this fee.

For updates regarding COVID-19 and the impact on City Services click here. Residential and commercial properties are assessed at 25 and 40 of appraised value respectively.

Chattanooga Tennessee Mountain Communities Jasper Highlands Tennessee Travel Chattanooga Tennessee

Chattanooga And Hamilton County Tax Calculator Metro Ideas Project

City Of Clarksville Releases Quick Facts About Transportation 2020 Clarksville Online Facts City Clarksville

Chattanooga Mayor Tim Kelly Seeks To Increase City Pay With 30 Million Tax Revenue Hike Chattanooga Times Free Press

City Of Chattanooga Chattanooga Gov Twitter

Chattanooga City Council Approves Budget Including Pay Raises And Property Tax Increase Chattanooga Times Free Press

New Day New Way Bereft Of Power To Take At Will Tennessee Cities Will Have To Sell Themselves To Grow Chattanooga Times Free Press

City Of Chattanooga And Hamilton County Will Lose Money On Building Deals Chattanooga Times Free Press

Job Openings City Of Chattanooga

Chattanooga Hamilton County Tn Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

City Of Chattanooga Chattanooga Gov Twitter

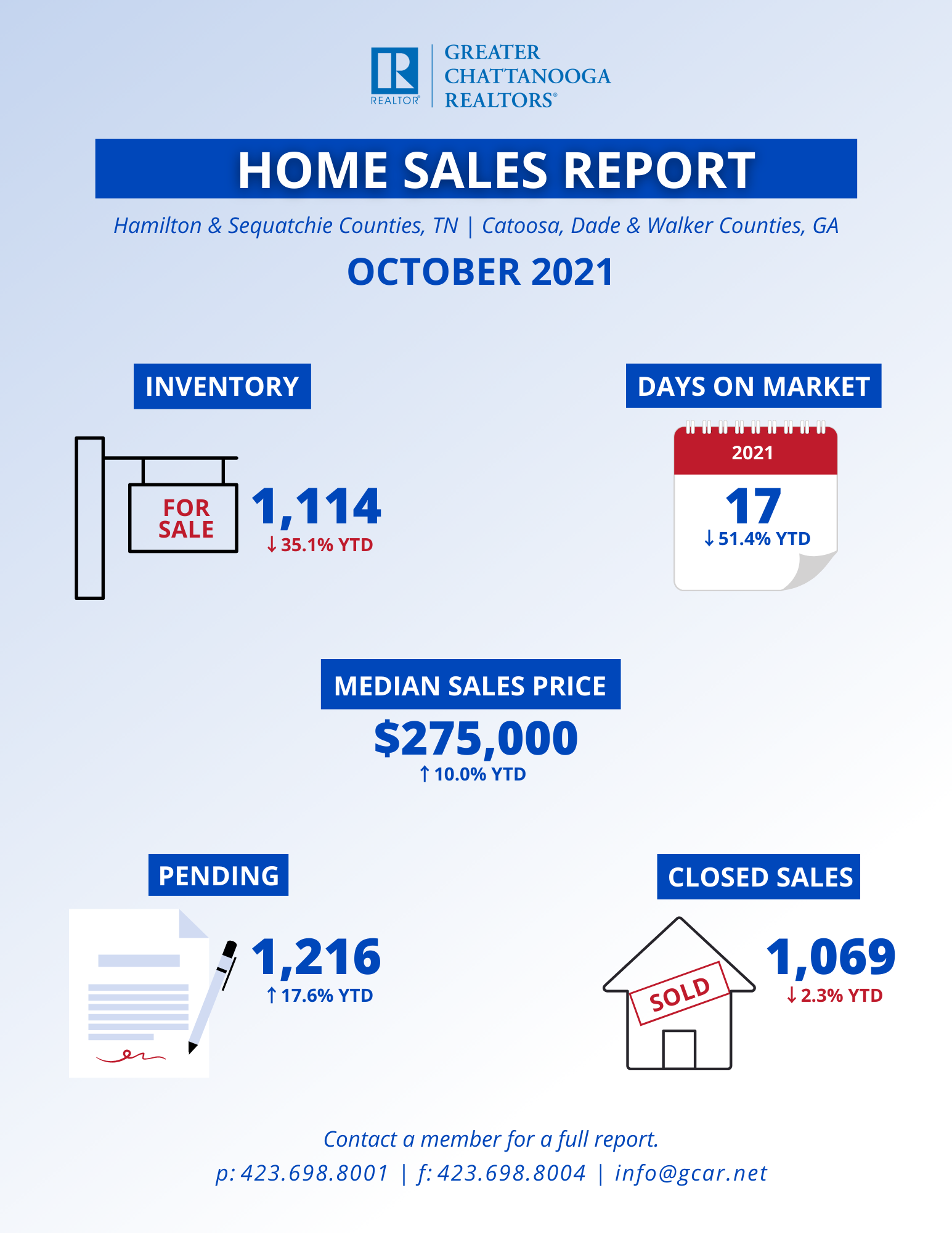

Cities With The Most Expensive Homes In Chattanooga Metro Area Stacker

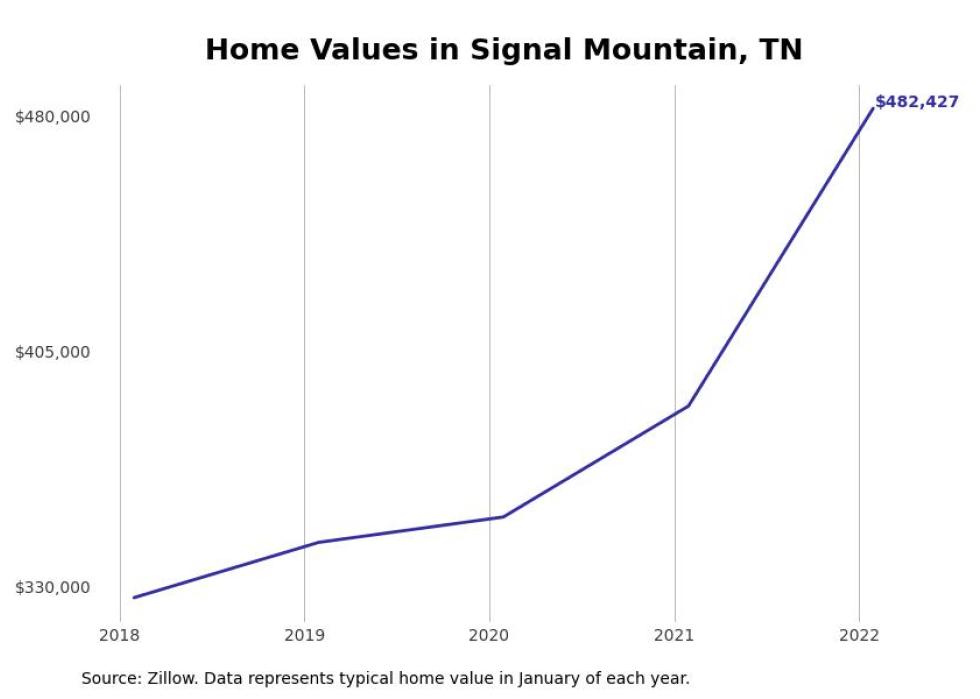

Growth In Chattanooga Area Home Prices To Lead Tennessee In 2022 Forecast Says Chattanooga Times Free Press

Downtown Baton Rouge Louisiana Jak D Photography Louisiana Travel Family Vacation Travel Louisiana Photography

Chattanooga Cost Of Living Is Chattanooga Affordable

City Of Chattanooga Chattanooga Gov Twitter

Bowling Green Kentucky Homes Under 250k New Mexico Homes South Carolina Homes Carlsbad

New Chattanooga City Budget Includes Property Tax Increase For Some River City Homes